Save time and gain visibility with LawVu’s enhanced accruals management feature

At a time when corporate legal teams are under pressure to handle growing workload and control costs with limited resources, effective and efficient handling of legal spend and related workflows – from budgeting and invoice review to reporting – is crucial.

And yet, when it comes to managing accruals, too many teams are struggling with highly manual, error-prone processes and limited data and visibility. Luckily, there’s a better way to manage accruals, with LawVu’s new accruals management feature – the latest in a series of high value feature enhancements to augment spend management capabilities in the LawVu legal workspace.

A quick primer on legal accruals management

Accruals are your unbilled estimated spend. They are an essential part of legal budget management – one that can help your finance team forecast expenses and give you the visibility you need to maintain financial control and set clear expectations with other teams, outside firms and legal service providers (LSPs).

Here’s an easy way to think about accruals: work performed by outside counsel is often in progress, spanning weeks, months or years. Under the accrual method of accounting, when work by outside counsel begins, an expense has occurred. However, nothing has been entered in the accounting records for that expense because it hasn’t been completed and paid for yet.

Legal and financial teams may need to account for this “known unknown” – effectively, an estimate of the cost of work – for accurate record keeping and budget projections. Many legal teams are familiar with accrual estimates and pending invoices, which are the most common types of accruals.

Accruals management involves tracking and managing the financial obligations that a legal department or firm has incurred but not yet paid. It typically includes:

- Tracking Unbilled Expenses: Monitoring legal services and expenses that have been incurred but not yet invoiced.

- Forecasting Future Costs: Estimating upcoming legal expenses to ensure sufficient budget allocation.

- Reconciling Accounts: Ensuring that all financial records accurately reflect the legal services provided and expenses incurred.

- Reporting: Providing detailed reports on accrued expenses to stakeholders for better financial planning and decision-making.

Effective legal accruals management helps organizations maintain financial accuracy, improve budgeting, and enhance overall financial transparency. For the legal team, better accruals management is an opportunity to save time, control costs, improve operations, and be a better business partner to key stakeholders like the finance team.

The challenges of accruals management for in-house legal teams

Managing accruals can be a daunting task for legal teams. Unfortunately, unbilled estimates are challenging to collect, capture, and report on, and can be rife with inefficiencies. Here are some of the biggest problems teams face:

- Inefficiency and manual process: A lot of time is wasted going back and forth in email to get the information needed to report on outstanding costs. Even if the information can be collected, it takes time to compile, and many teams use unreliable, error-prone and time consuming tools like spreadsheets to do the work.

- Low response rates: Despite numerous requests, lack of information from law firms and LSPs is common. Misaligned priorities and unclear submission processes can often result in incomplete information.

- Lack of resource: Busy legal teams do not have enough time or resources to manage the process closely enough to ensure that the information they need is complete, accurate, and available on demand.

- Lack of data: If you can’t collect the information you need, timely reporting and useful insights are nearly impossible to come by. When it comes to accruals, data is not only often unreliable in its accuracy, it’s also hard to obtain without engaging in time-consuming manual processes. Even if the data is available, limited resources and skill sets can make it challenging to create actionable reports which make trends accessible and actionable for finance and other stakeholders.

How e-billing and spend management tools solve your accruals issues

E-billing and spend management software, like the LawVu legal workspace, automates legal operations processes. This includes digitizing invoices from outside counsel, streamlining approval and reporting workflows for those invoices, and making collaboration with outside counsel more secure and efficient.

When it comes to accruals, these software solutions rely on automated tools to reach out and collect the information you need. This is far more efficient than having a member of the legal team devote hours of their day to manually contacting law firms, consolidating data for unbilled estimates, and formatting that information for the finance team and business stakeholders.

With billing and accruals digitized, legal leaders can save valuable time and gain complete control over their legal budget.

Here are the benefits of using LawVu’s new accrual management capabilities:

- Enhanced efficiency: Automating routine tasks and reducing the need for constant back-and-forth communication saves valuable time and boosts overall productivity.

- Improved accuracy: Streamlining processes reduces human error and lowers the risk of incomplete data, resulting in more accurate financial reporting. In the case of accruals management, e-billing software increases your accrual request response rate, not only providing your legal department with the data it needs to evaluate law firm performance, but giving your finance department the numbers they need to get their job done.

- Reliable data repository: With data stored in a reliable repository that acts as a single system of record for accrual estimates, pending invoices, and rejected invoices, you’ll have visibility and easy access to data you need for reporting and planning.

- Better collaboration: LawVu makes it easier for legal to collect and provide the information that finance and other stakeholders need, fostering collaboration through shared and timely access to updated data and reports.

It’s worth noting that, in addition to providing insight and data needed for budgeting, planning, and reporting, replacing manual administrative work with automated approval workflows delivers significant value to legal teams and their businesses. Here’s how:

- Saving just two hours a week of an attorney’s time is worth more than $11,000 USD per year.

- Every hour saved is time that can be spent on higher value legal and strategic work – leading to positive commercial outcomes and critical risk mitigation.

- This allows legal teams to scale their service, managing increasing volumes of work and complexity for their businesses with careful allocation of resource and spend.

Key features of LawVu’s accrual management tool

Now that we understand why it’s so useful, let’s take a look at how LawVu’s spend management capabilities help legal teams streamline accruals management and improve legal operations. LawVu’s accruals management feature is packed with functionality tailored to the needs of corporate legal teams, including:

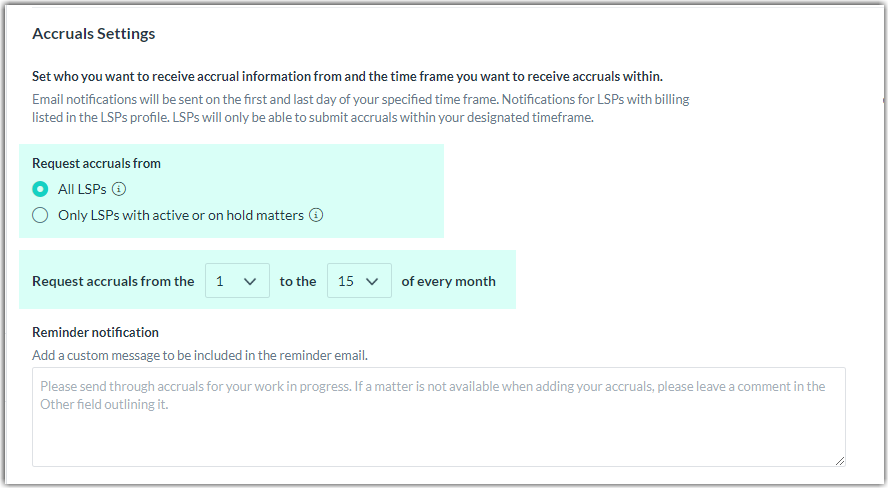

1. A simple administrative console that lets you easily set up accrual request periods and customize email notifications to your firms and LSPs. This means you don’t have to send emails yourself – it just happens automatically at the right time!

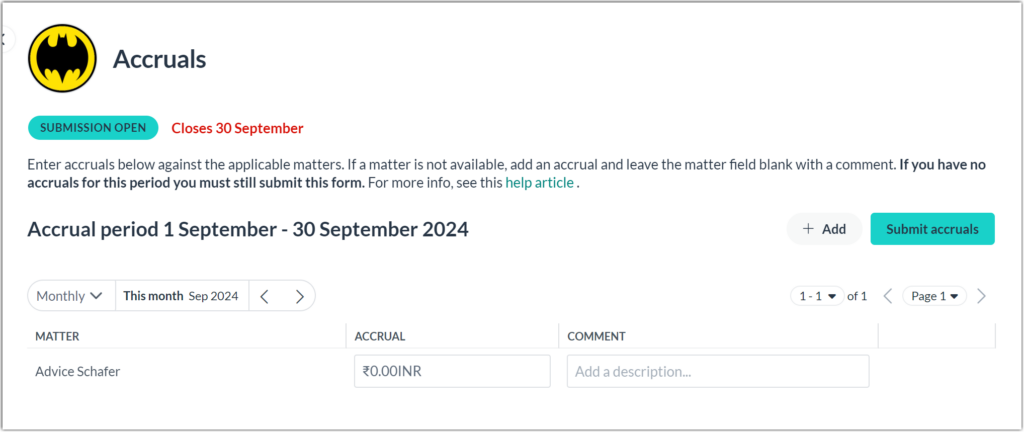

2. A simple experience and great user interface for outside counsel. That means that once they receive your automated notification, it’s easy for your firms and LSPs to jump into LawVu to add the information you need to estimate and report on legal spend.

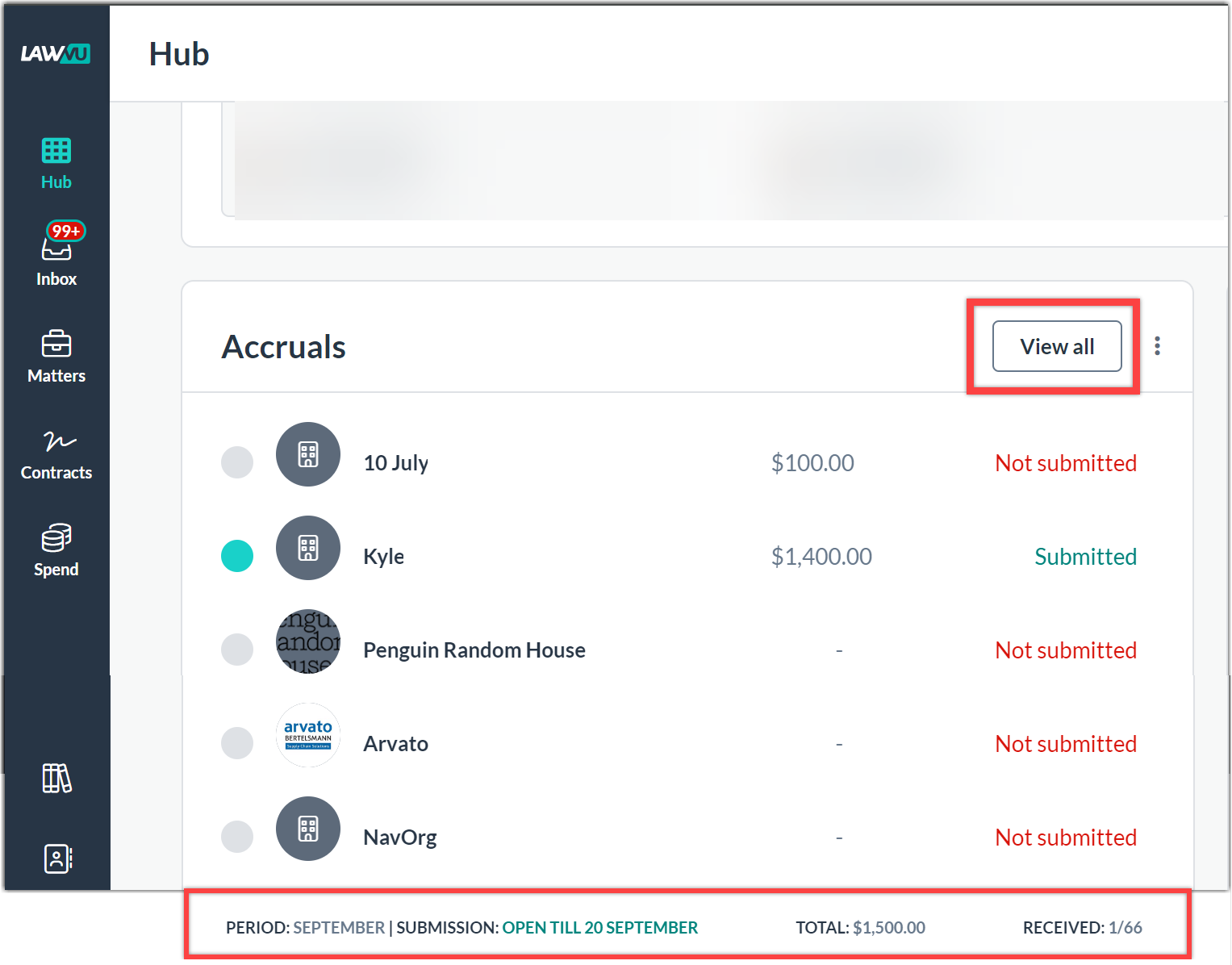

3. The ability to add an Accruals report widget to the LawVu Hub so you can see what has been submitted and what is outstanding for the accrual period you care about. This ensures that nothing falls through the cracks – and you don’t have to worry about keeping track of things manually.

4. Flexible reporting through accrual grids, so you can include all the information that your stakeholders – including finance – need.. You can easily export and send the information in a spreadsheet format or send specific updates via email at any time.

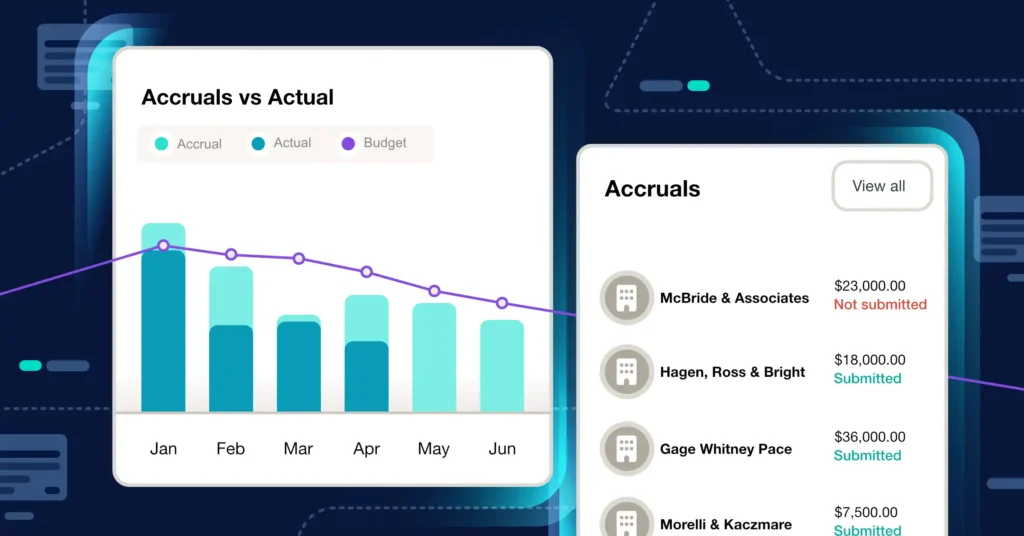

5. New accruals and spend dashboards make it easy for you to get a holistic view of real and estimated spend against budgets. They also give you the ability to gauge how well each law firm does when it comes to providing accurate estimates for work in progress.

Why legal should own the accruals management process

While finance departments have traditionally managed accruals, legal operations are better positioned to take ownership of this process. Here’s why:

Closer relationship with law firms

Legal teams have direct contact with law firms and are more familiar with the intricacies of each case. This proximity allows them to provide accurate context for accrual estimates, leading to more precise financial forecasting.

Expertise in legal spend

Legal operations teams understand the nuances of legal spend and are equipped to evaluate law firm performance based on accrual submissions. This expertise ensures that accruals are aligned with legal and organizational objectives.

Strategic decision-making

By owning the accruals process, legal teams can leverage data to make informed decisions that drive better outcomes for both the legal department and the organization as a whole.

Simply put, when it comes to accruals management, finance relies on legal to provide this estimate. Meanwhile, in turn, the legal team relies on its outside law firms to estimate the cost of the work based on the scope of the project and the timekeepers involved.

Ultimately, e-Billing software can be used to benefit both the finance and legal department, giving all the stakeholders involved in accrual collection the ability to access key data points, status updates, and reports they need. This makes it easy for the two teams to work together.

But, as legal departments start to carry multi-million dollar budgets, they must be as quantitative as possible to effectively meet organizational expectations and demonstrate the value of the department. E-billing solutions solve this problem, giving legal access to metrics that make it easier to control, manage, and predict spend. With accruals and spend management in hand, legal teams have more of the data they need to manage their function, collaborate with LSPs and firms, and showcase their value.

How to get started with LawVu accruals management

Effective accruals management is crucial for corporate legal departments who want to control costs, be more impactful, and increase efficiency. Are you ready to transform your accruals management?

- If you’re a LawVu customer and are currently utilizing our spend management and e-billing features, you can simply reach out to your LawVu representative or use the 24/7 support chat feature for a demo. Our help center has everything you need to get started, including templates and training links you can share with your LSPs.

- If you are not currently using LawVu’s spend management and e-billing capabilities, request a demo now to discover how the LawVu legal workspace could save your team valuable time and effort, generating the data and analytics you need to communicate value and control costs.

You can learn more about LawVu spend management and e-billing here.