Legal teams today are being asked to do more with less – all while keeping outside counsel costs under control, dealing with scattered invoices, and answering constant questions from finance about budgets. When everything lives in emails, PDFs, or spreadsheets, it’s almost impossible to get a clear picture of what’s been spent or what’s coming next.

That’s where legal spend management and e-billing software give in-house legal teams total control over their legal spend, centralizing legal workflows and giving teams the visibility and confidence to manage spend proactively. Below, we break down what the features do, how they work, and why they help legal departments run more smoothly.

Legal spend management is how legal teams track, analyze, and manage the costs of internal and external legal work. E-billing is the digital submission, review, and approval of invoices from law firms – enabling accurate spend tracking, automated compliance checks, and faster processing. Essentially, e-billing is one part of spend management, and when used together they provide the foundation for financial transparency and operational control in modern legal departments.

To understand the real value of spend management and e-billing, it helps to see how the process fits together. While every platform works a little differently, most follow the same core flow: firms submit invoices digitally, the system checks them against your billing rules, approvals move quickly, and all that data rolls up into useful reports. Here’s a simple step-by-step breakdown of how it works in practice.

Law firms submit LEDES or standard-format invoices such as PDFs through the e-billing platform, ensuring consistent, structured data.

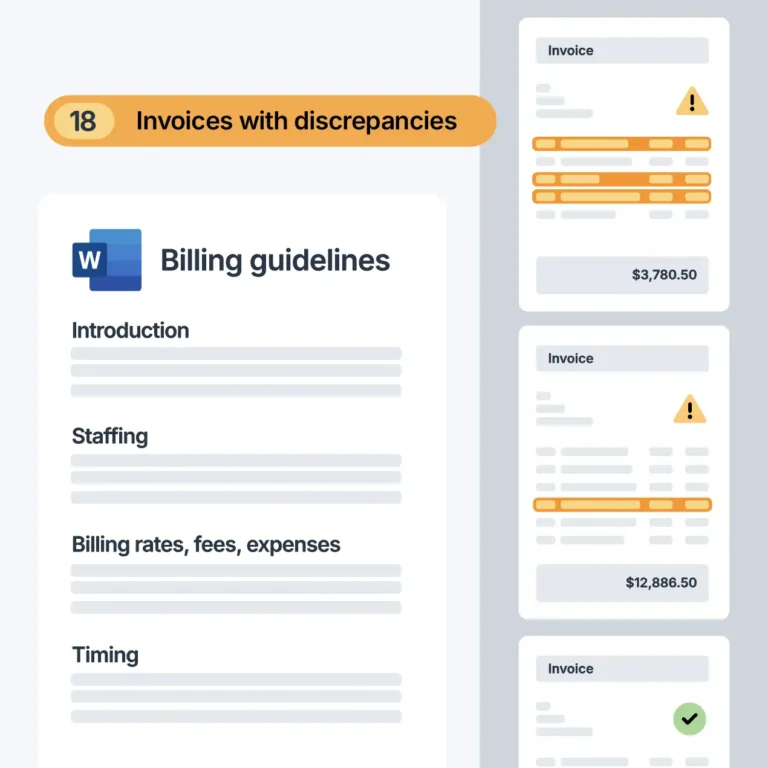

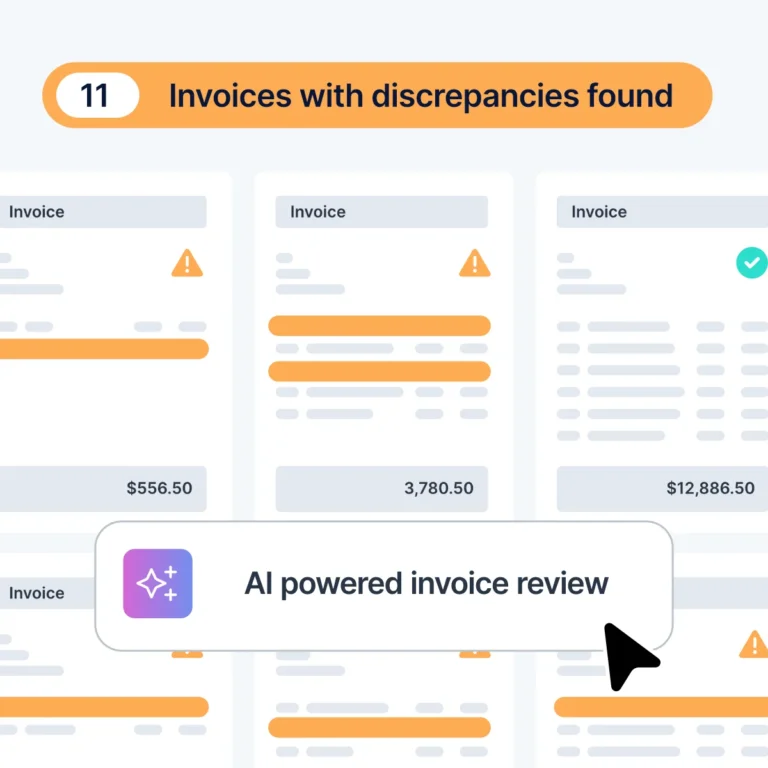

The system applies an organization’s billing guidelines, checks for rate discrepancies or prohibited charges, and automatically flags non-compliant line items. This ensures compliance with agreed guidelines and rates.

Invoices move through a streamlined approval workflow and are routed to the right people for compliance. Once approved, invoices are automatically forwarded to finance or other departments for payment and reconciliation.

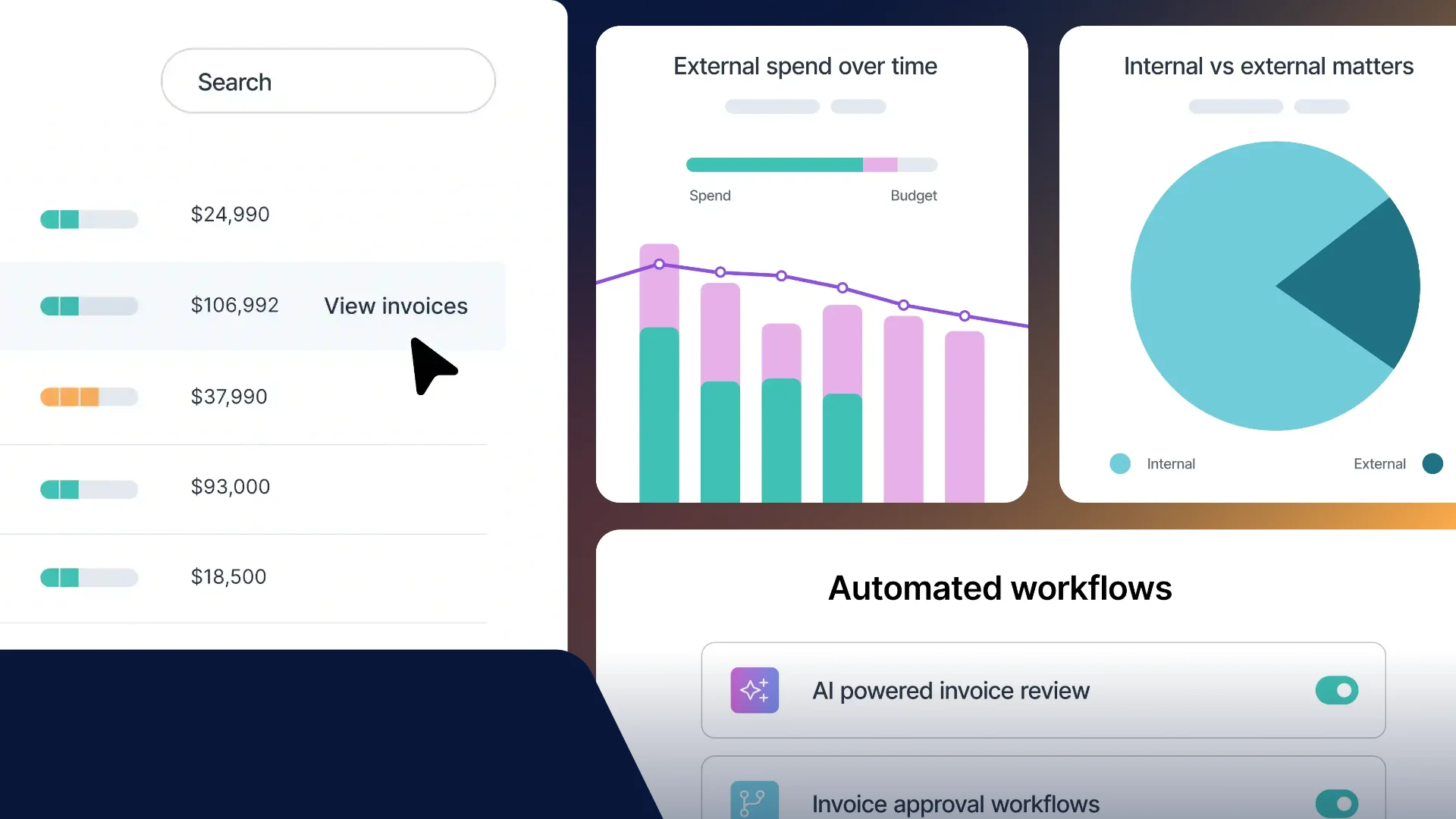

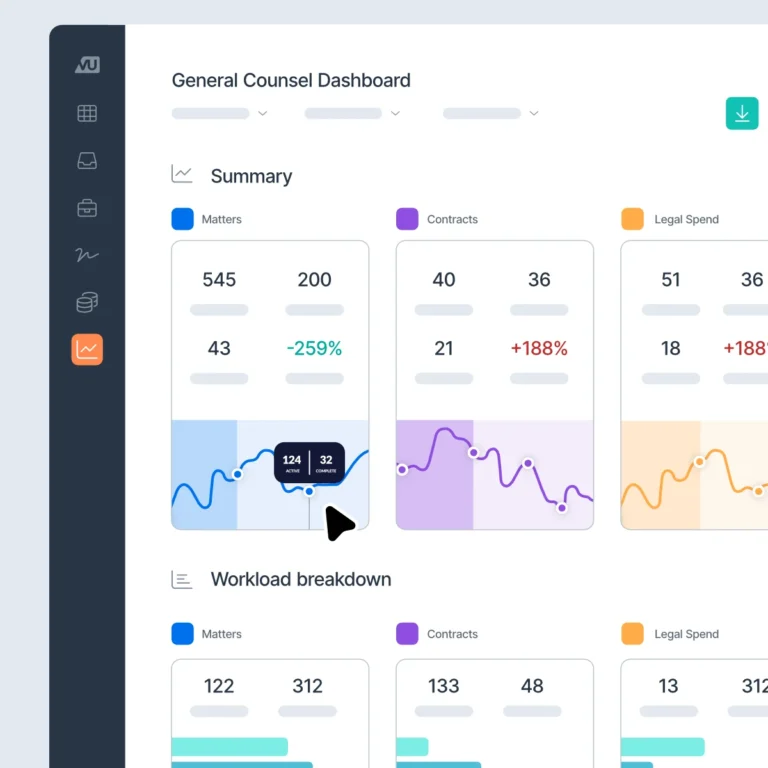

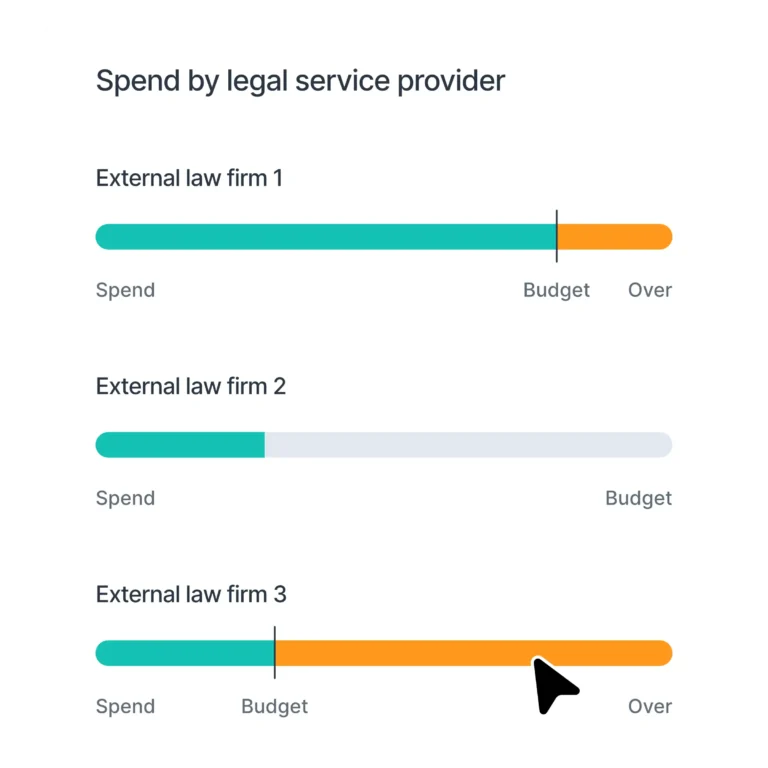

All invoice and matter data feeds into dashboards and reports, helping corporate teams forecast budgets, analyze vendor performance, and identify trends to optimize spend and make data-driven decisions.

Legal spend management and e-billing become far more powerful when you break them down into the specific features that drive real impact for in-house teams. Each capability plays a role in reducing manual work, improving visibility, and helping legal and finance stay aligned. The table below highlights the key features and explains why they matter – along with the practical benefits your team can expect.

Spend management and e-billing tools become most useful when you see how they solve the real problems legal teams deal with every day. From messy invoice reviews to budget planning and rate negotiations, these features streamline the tasks that usually take the most time and create the most friction.

Below are a few common scenarios that show how the technology works in practice and the difference it can make to your workflow.

Finance rejects invoices because charges don’t match agreed terms. E-billing automatically applies your billing guidelines, flags discrepancies and unapproved charges, and ensures invoices are compliant before review.

The General Counsel prepares an annual budget. Spend analytics dashboards show historical spend, current burn, and cost trends – creating more accurate forecasts in minutes.

Legal operations need to compare hourly rates for multiple firms. Timekeeper rate data reveals patterns, enabling data-backed rate negotiations and smarter panel management.

Collecting accruals from multiple LSPs can be slow and manual. Automated reminders and structured submission workflows prompt providers to submit their accruals on time – often in bulk – so nothing gets missed. This reduces follow-up work for legal ops and ensures more accurate, timely reporting for finance.

Legal spend management and e-billing are no longer optional – they’re essential capabilities for legal teams that need financial visibility, predictable budgets, and consistent billing compliance. By centralizing invoice workflows and surfacing actionable data, these tools help teams make smarter decisions and demonstrate financial governance to the business.

Explore our upcoming Buyer’s Guide to Legal Spend Management to help you evaluate the right solution for your team or watch this quick demo to see how spend management works in LawVu to support your team’s financial and operational goals.

If you’re exploring spend management and e-billing solutions to keep legal costs under control, there are plenty of ways to take the next step.

Learn the fundamentals in What is Legal Spend Management? and explore our upcoming Legal Spend & E-Billing Buyer’s Guide for a practical framework to help you select the right solution for your team.

Book a personalized demo to see how LawVu brings spend management and e-billing together in one connected platform—and how it can work for your organization.

In-house legal teams are under more pressure than ever to keep costs under control, stay on top of budgets, and clearly show where money is being spent. But relying on emails, spreadsheets, or manual invoice reviews makes it challenging to get the visibility and accountability the business expects. That’s why more teams are turning to spend-management and e-billing tools that centralize information, streamline invoicing process, monitor spend, and make reporting much easier.

This FAQ breaks down the basics and helps you understand how these tools can bring clarity, efficiency, and confidence to your legal operations.

Legal spend management is the process of tracking, analyzing and controlling the costs both inside the legal department and with outside counsel – including budgeting, invoice review, and reporting. It enables legal teams to move from reactive invoice processing to proactive cost-control and strategic legal-vendor management.

E-billing refers to the digital submission, review, and payment of invoices from outside counsel or legal service providers, typically delivered via a platform rather than paper or manual spreadsheets. It streamlines invoice processing, enforces billing guideline compliance, and gives legal teams a clearer, faster window into external counsel spend.

Spend management software links each matter to its budget, monitors invoices and accruals, applies billing guideline rules and provides dashboards and reports across vendors, matter types, and spend categories. It automates many manual review tasks (for example flagging non-compliant line items), data entry, tracks what’s been spent vs remaining budget, and helps forecast upcoming legal costs.

Without a dedicated tool, in-house teams lack timely visibility into what’s being spent, where budgets may be blowing out, and whether invoices comply with internal guidelines. A spend management platform helps avoid surprises, reduce administrative load, better enforce billing policies, speed up invoice review process, and support smarter negotiation and better relationship with outside counsel. Read this article to learn more about common pain points legal teams struggle with and where spend management can help.

Key capability usually includes automated invoice submission and review workflows, built-in billing guideline enforcement, seamless linking of invoices to matters and budgets, and real-time analytics that show where spend is going. Modern spend management platforms should also offer AI-powered features that speed up invoice processing and reduce administrative effort. Together, these capabilities help legal teams shift from manual, error-prone processes to a more controlled, transparent, and data-driven way of working.

Spend management systems deliver ROI by reducing billing errors and over-charging, improving the accuracy of forecasts, and giving legal teams stronger leverage in outside counsel negotiations. They also free up legal operations capacity by automating manual review tasks, allowing teams to focus on higher-value work. Over time, this translates into tighter cost control, fewer budget surprises, and more strategic use of legal resources. And when spend management sits within a unified legal workspace, teams gain even more value through streamlined workflows and better visibility across all legal work – not just spend.

E-billing focuses on the invoicing process – the submission, review and payment of outside counsel bills in digital form. Spend management is broader: it encompasses invoicing and budgeting, analytics, forecasting, and vendor-performance management. In short, e-billing is one piece of the spend-management puzzle.

Absolutely. Even smaller or mid-sized legal teams can gain cost control, transparency, and process efficiencies by adopting a spend management tool scaled to their size. Many platforms are designed to accommodate lower volume while still bringing the structural benefits of matter tracking, budget oversight, invoice review automation, and analytics.

Key KPIs include invoice cycle time, budget variance, billing guideline compliance rate, and forecast accuracy. Teams may also measure savings from rejected or adjusted line items, along with law firm performance metrics. These indicators help legal leaders demonstrate value and operational maturity.

There are many strong platforms on the market, each offering different strengths in areas like automation, analytics, scalability, and integrations. The right choice really depends on your team’s size, budget, region, and specific workflow needs. For an objective comparison, we recommend reviewing vendors side-by-side or exploring our buyer’s guide to help identify the best fit for your organization.

This glossary is designed to help in-house legal teams understand the key terms and concepts that shape modern legal spend management and e-billing. Whether you’re building out legal operations, evaluating software, or refining your financial processes, these definitions offer a practical guide to the terminology you’ll encounter along the way.

Accruals represent the estimated fees and expenses that outside counsel have incurred but not yet invoiced. They give legal and finance teams a real-time view of upcoming liabilities, helping improve forecasting accuracy and prevent budget surprises.

AFAs are billing models that differ from traditional hourly billing. Examples include fixed fees, capped fees, success fees, and volume-based discounts. They provide more cost predictability and can align law firm incentives with business outcomes.

Legal budgeting involves estimating and planning expected spend across matters, projects, or fiscal periods. Proactive budgeting gives in-house teams better financial control, enables more accurate forecasting, and supports meaningful conversations with finance and business stakeholders.

Billing guidelines are a set of rules that outline how outside counsel should bill for their work – covering rates, staffing, disbursements, formats, and prohibited charges. Clear, well-communicated guidelines help ensure consistency, reduce overbilling, and support fair, efficient invoicing.

E-billing is the digital submission, review, and approval of invoices from law firms through a centralized platform. It streamlines invoice processing, enforces compliance with billing guidelines, and forms the foundation of modern in-house legal spend management.

Invoice compliance refers to how well outside counsel invoices align with a company’s billing guidelines and contractual terms. Spend management and e-billing software automate this process by flagging violations, applying rules, and reducing the manual effort required to ensure accuracy.

Rate management involves tracking, reviewing, and approving the hourly rates charged by different law firm timekeepers. Effective rate management helps control escalating costs, supports negotiation, and ensures alignment with budget expectations.

Legal spend analytics is the practice of examining billing and matter data to identify trends, cost drivers, outliers, and opportunities for efficiencies. Insights may include vendor performance, in-house vs external work, and spend by matter type – enabling more strategic decision-making.

A Master Retention Agreement is a formal contract that establishes the overall terms under which a company engages a law firm or legal service provider. It typically covers agreed rates, staffing expectations, billing guidelines, confidentiality, and governance for future matters. MRAs streamline onboarding, create pricing consistency, and reduce the need to renegotiate terms each time a new matter arises. They also support stronger vendor management by ensuring all work operates under a clear, pre-approved framework.

OCGs are formal documents provided to law firms that detail expectations around billing, communication, staffing, and matter management. They play a central role in e-billing compliance and help ensure law firms operate within agreed-upon parameters.

Spend management is the process of tracking, managing, and analyzing legal department costs – including budgeting, invoice review, accruals, and vendor performance. It enables teams to move from reactive invoice handling to proactive financial control. Learn more.

Timekeeper rates refer to the hourly rates charged by partners, associates, paralegals, and other law firm professionals and legal service providers working on a matter. Tracking these rates helps legal teams compare firms, control costs, and verify compliance with agreed-upon pricing.

Vendor management encompasses how legal operations teams evaluate, onboard, and manage relationships with law firms and other legal service providers. It includes monitoring performance, reviewing spend, maintaining guidelines, and ensuring vendors deliver value aligned with business goals.